“No country should fantasise that it can suppress China and maintain a good relationship with China at the same time,” Chinese Foreign Minister Wang Yi said during a lacerating address directed at the US on Friday. “Such two-faced acts are not good for the stability of bilateral relations or for building mutual trust.”

China’s blusterous attack comes as the US imposed the second of two 10 percent tariffs on China’s imports this week in a tit-for-tat exchange between the sparring trade partners that resumed on Trump’s return to the White House. Beijing has hit back with additional 15 percent duties on US imports including chicken, pork, soy and beef, and expanded restrictions on doing business with major US companies.

The Trump administration maintains that its tariffs are warranted to deter the smuggling of fentanyl from China that has fuelled a deadly drug crisis in the US. Beijing says it has taken steps in recent years to clamp down on the problem and that the US should handle its drug crisis as a domestic issue.

“The US imposition of 20 percent tariffs on Chinese products on the basis of fentanyl is groundless and a typical act of protectionism, unilateralism and bullying,” a spokesperson for China’s commerce ministry said in a statement on Friday.

Read moreTrump’s trade wars intensify as US tariffs on Canada, Mexico and China take effect

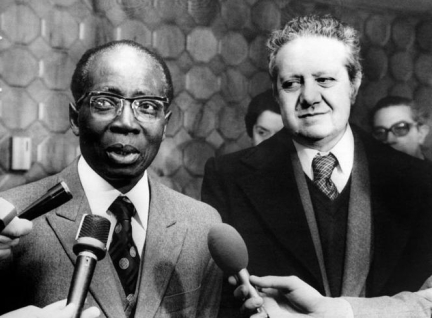

World Trade Organization Director General Ngozi Okonjo-Iweala weighed in, urging US trading partners to refrain from hostilities and instead engage in dialogue with the US.

Financial markets were poised for sluggish growth in coming months off the back of the latest tariffs. However, China maintains its economy is resilient and that trade with other countries can make up any shortfall in export revenues.

One of your browser extensions seems to be blocking the video player from loading. To watch this content, you may need to disable it on this site.

FRANCE 24 spoke to John Minnich, an assistant professor in international relations at the London School of Economics, about the escalating trade rift threatening US-China relations and what we can expect by way of retaliation from China if pushed further by Washington.

Given comments today by China’s foreign minister Wang Yi, how would you describe China-US trade relations right now? Are the US and China officially in a trade war?

The US and China have been locked in a form of trade war since 2018, when the Trump administration had imposed tariffs of between 7.5-25 percent on roughly 70 percent of imports from China.

The Biden administration by and large maintained those tariffs. So, in this context, it’s better to think of the Trump administration’s new tariffs as a resumption of hostilities in an ongoing conflict rather than the start of something new.

That said, the recent trade sanctions do mark a potentially significant escalation in the war, not least because so far, many American firms who manufacture in China for export to the US and who secured exemptions from the 2018 tariffs have not been exempted from these tariffs, most notably Apple.

This is significant given the continued importance of Apple and other US electronics firms to China’s export engine – and in turn, to employment in China. It could also mean the inflationary impact of these tariffs in the US is somewhat higher than before.

Wang issued a warning that China will “firmly counter” any pressure from the US. Where would it draw the red line? What form could retaliatory action take?

The Trump administration’s actions do not come as a surprise to China. Officials have been preparing for new trade pressures from the US for many months. Their response will likely take two broad forms.

First, as in the 2018-2019 phase of the trade war, Beijing will impose reciprocal tariffs on imports from the US. These tariffs will likely target sectors there in which the US runs trade surpluses, such as agricultural goods and aircraft and associated components, and will be calibrated to cause political pain for Trump and Republicans in Congress.

Research by Sung Eun Kim and Yotam Margalit showed that in 2018 China systematically targeted Republican-leaning counties in contested districts, and that this strategy succeeded in hurting Republicans in the 2018 mid-term elections. I would expect China to do something similar here.

Second, it will likely penalise US firms with operations in the country or over which Beijing can exert some regulatory influence. In December 2024 and February of this year, China announced antitrust investigations into Nvidia and Google. I would not be surprised to see similar actions against other major American technology and manufacturing firms. The Chinese will want to demonstrate that even though direct US exports to their country are relatively small (compared to Chinese exports to the US), US firms remain highly dependent on China both as a market and a manufacturing base.

China has vowed to prioritise domestic demand to drive up its economy and counteract the effects of US tariffs. Can this strategy work?

China’s leaders have understood the importance of rebalancing the economy towards greater reliance on domestic household consumption for some time, but the political and economic obstacles are immense. In this context, the Trump administration’s new tariffs are politically expedient for Beijing, as they provide an excuse to push through otherwise politically difficult reforms.

It’s not surprising that over the past few months China’s leaders have signaled renewed resolve to promote household consumption. Not only is this needed for China’s economy, but rising external pressures also make it more politically tenable. All else equal, I think we are likely to see stronger consumption growth this year, buoyed by various forms of government support.

That does not mean China will be successful in fully rebalancing towards a consumption-led growth model in the next two, five, or even ten years.

The obstacles to doing so remain enormous, from reforming the fiscal base (especially for local governments) and the state-owned enterprise and banking sectors, to relaxing restrictions on internal migration, and much more.

Trump likes to tout his credentials as a deal maker. What kind of a deal might China be prepared to cut with the US to de-escalate tensions?

I suspect China would be willing to substantially increase imports from and invest heavily in rebuilding manufacturing in the US in return for relief on tariffs and technology export controls.

The question is whether Chinese commitments to buy US soybeans and the like will be sufficient to assuage the Trump administration. I suspect not, especially given that China backtracked from its previous purchase commitments due to the Covid-19 pandemic in 2020.

It is also unclear whether the US would allow large-scale Chinese investments in manufacturing in the US. Although Trump has repeatedly suggested his support for this, many policymakers in Congress and the US government will be wary of potential threats to national and economic security. There is speculation the Trump administration will pursue something akin to the 1985 Plaza Accords, at which Washington got Japan, Germany, the UK and others to agree to a devaluation of the US dollar in a bid to revitalise American manufacturing.

I would be surprised if China agrees to any such deal that threatens its current position as the world’s dominant manufacturing power by substantially raising the relative cost of production in China.

Can China’s tech economy effectively buffer against the effects of Trump’s tariffs?

The parts of China’s tech economy that are most exposed to US tariffs are those tied to electronics supply chains ultimately controlled by American firms such as Apple, Qualcomm, and Intel.

Although tariffs will undoubtedly have indirect effects on Chinese firms like Huawei, SMIC (Semiconductor Manufacturing International Corporation), BYD, and so forth, the reality is that these firms do very little direct or indirect trade with the US. The same goes for most Chinese internet platform companies, with the notable exception of TikTok owner ByteDance. I could see TikTok become hostage to an escalation of trade tensions.

The tariffs could have downstream consequences for its tech economy if they substantially hit overall economic growth in China, constraining domestic demand and the resources available to the Chinese government to support continued technological upgrading. But I think the more acute risk for China is all the employment tied to exports of lower value-added goods, which still make up the bulk of China’s trade with the US.

Leave a Comment